The Career Up Grant is a government subsidy designed for companies and sole proprietors who want to secure excellent talent but have limited room in their personnel budgets. It has two main pillars—“Support for Regularization” and “Support for Better Treatment”—with the aim of stabilizing the labor market and improving corporate productivity.

In this column, we explain the most widely used sub-program under the Regularization pillar: the “Regular Employee Conversion Course.”

まずはお気軽に無料相談・

お問い合わせください!

目次

- 1. What is the Career Up Grant “Regular Employee Conversion Course”?

- 2. Application Procedure

- 【Step 1】Prepare & File a Career Up Plan

- 【Step 2】Add a Regular-Employee Conversion Rule to the Work Rules

- 【Step 3】Convert the Employee Based on the Work Rules

- 【Step 4】Pay Six Months of Wages After Conversion

- 【Step 5】Apply for the Subsidy (Phase 1)

- 【Step 6】Pay Wages for Months 7–12

- 【Step 7】Apply for the Subsidy (Phase 2)

- 3. Required Documents for the Regular Employee Conversion Course

- 4. Summary: Career Up Grant “Regular Employee Conversion Course”

1. What is the Career Up Grant “Regular Employee Conversion Course”?

Put simply, this program pays a subsidy when you convert a “non-regular” worker in your company—such as a dispatch worker, fixed-term contract worker, or part-timer—into a regular employee.

The amount depends on company size and on the employee’s employment type prior to conversion. Previously, the maximum was ¥800,000 in a single application; fiscal year the payment is split into two phases, up to ¥400,000 per phase.

Thorough preparation is essential, because it can take more than a year from application to payment,

(1) Subsidy Amounts for “Regular Employee Conversion Course”?

Subsidy amounts for the “Regular Employee Conversion Course” are as follows.

| Company size | Condition | Amount per employee (2 phases total) |

|---|---|---|

| SME | Fixed-term non-regular ⇒ Regular employee | ¥800,000 (¥400,000 × 2) |

| SME | Indefinite-term non-regular ⇒ Regular employee | ¥400,000 (¥200,000 × 2) |

| Large company | Fixed-term non-regular ⇒ Regular employee | ¥600,000 (¥300,000 × 2) |

| Large company | Indefinite-term non-regular ⇒ Regular employee | ¥300,000 (¥150,000 × 2) |

You may file the Phase 1 application once six months have passed after conversion to regular status. After a further six months (i.e., months 7–12), you may file the Phase 2 application.

There are also add-on amounts if certain conditions are met:

| Condition | Non-Regular⇒Regular | Indefinite-term ⇒ Regular |

|---|---|---|

| Dispatch worker is directly hired by the client company as a regular employee | ¥285,000 | ¥285,000 |

| Target employee is a single mother or single father | ¥95,000 | ¥47,500 |

| Regularization after completing training under the Human Resource Development Support Subsidy | ¥95,000 | ¥47,500 |

| You newly establish and apply a regular-employee conversion scheme | ¥200,000 (¥150,000 for large companies) | ¥200,000 (¥150,000 for large companies) |

| You newly establish and apply a “diverse regular employee” scheme* | ¥400,000 (¥300,000 for large companies) | ¥200,000 (¥300,000 for large companies) |

* “Diverse regular employee scheme” includes any one of: location-limited regular employee, duty-limited regular employee, or short-hours regular employee (if newly established as a制度 and applied).

(2) Who Counts as an Eligible Employee?

The Career Up Grant “Regular Employee Conversion Course” applies only to employees who meet specific criteria. Pay particular attention to the following seven checkpoints:

Eligible employees

- A fixed-term or indefinite-term non-regular employee* whose pay amount or pay calculation method has differed from regular employees’ for a cumulative period of six months or more.

- Not someone hired with a pre-promise to be employed as a regular employee.

- The previous employer and current employer of the target employee do not have a close capital, economic, or organizational relationship.

- The target employee is not within the third degree of kinship of the business owner or a director.

- The employee continues to be employed as a regular employee at the time of the subsidy application (cases of voluntary resignation are not eligible).

- There is no plan to convert the employee back to fixed-term or indefinite-term non-regular status after the subsidy application.

- The period remaining until the employee’s mandatory retirement is at least one year.

Here, “indefinite-term non-regular” means an employee with an open-ended contract who is not subject to the same employment conditions as regular employees.

If all seven items are checked “Yes,” the employee is eligible.

(3) Which Employers Are Eligible?

The “Regular Employee Conversion Course” also has requirements on the employer side. Please review these 15 points:

Eligible employers

- You are an establishment covered by Employment Insurance.

- For each Employment Insurance establishment, you appoint a “Career Up Manager.”

- For each Employment Insurance establishment, you prepare a Career Up Plan for target employees and obtain certification from the competent Prefectural Labour Bureau Director.

- You maintain documentation that clarifies working conditions, attendance, and wage payment status for the target employees, and you can explain how wages are calculated.

- You undertake Career Up measures during the Career Up Plan period.

- Your work rules, etc. specify a制度 for converting fixed-term non-regular employees to regular employees.

- Conversions from fixed-term to regular are implemented based on the制度 stipulated in the work rules above.

- You continue to employ the regularized employee for six months or more and pay wages.

- At the time of the subsidy application, the制度 continues to be in operation.

- After regularization, the employee’s pay has increased by at least 3% compared with the total pay in the six months prior to conversion.

- You have not caused the regularized employee to leave for employer-reason within six months after regularization.

- Any change in employment status is based on a制度 that requires the employee’s consent.

- The regularized employee is enrolled as an Employment Insurance insured person from the conversion date.

- The regularized employee is enrolled as a Social Insurance insured person from the conversion date (for establishments covered by Social Insurance).

- If you seek add-ons for newly establishing a location-limited/duty-limited/short-hours regular employee制度, you must newly establish such制度 during the Career Up Plan period and carry out conversion from fixed-term to regular under it.

We have tried to avoid technical jargon, but this is a large topic and can feel complex. If you Roumushi).

2. Application Procedure

Here is the actual flow to receive payment under the grant. There are seven main steps:

- 【Step 1】Prepare & file a Career Up Plan

- 【Step 2】Add a regular-employee conversion provision to the work rules

- 【Step 3】Convert the employee in accordance with the work rules

- 【Step 4】Pay six months of wages after conversion

- 【Step 5】Apply for the subsidy (Phase 1)

- 【Step 6】Pay wages for months 7–12

- 【Step 7】Apply for the subsidy (Phase 2)

Each step has key points to watch—see below.

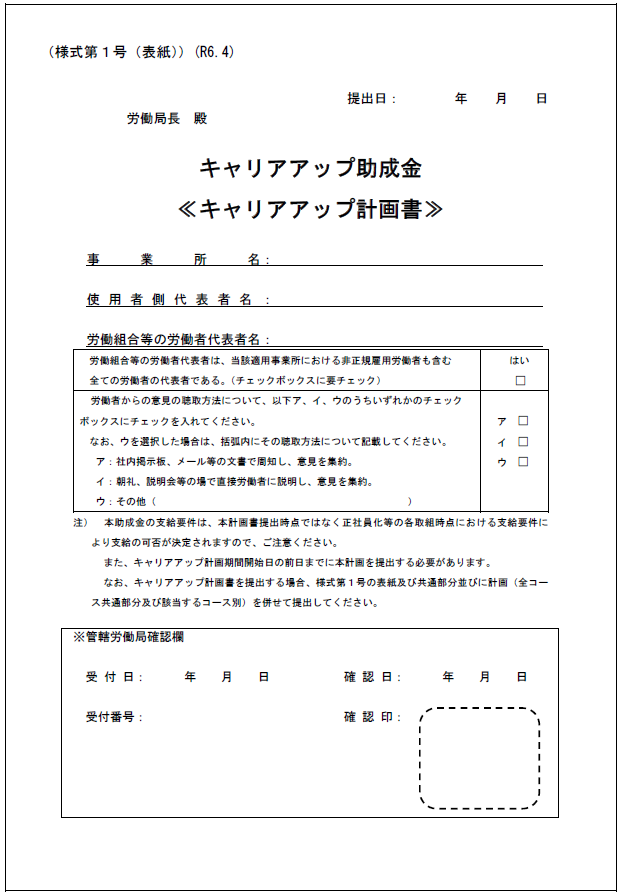

【Step 1】Prepare & File a Career Up Plan

For each establishment, appoint a “Career Up Manager,” and compile a designated plan covering targets, period, goals, and the company measures to achieve those goals. The plan period must be at least 3 years and no more than 5 years.

Notes

◆ Submit no later than the day before the start date of plan implementation.

File the plan with the competent Hello Work office by the day before the start date. If sending by post, “the date received by Hello Work” is the filing date—mail with ample time.

◆ One Career Up Manager per establishment.

A single person cannot serve as Career Up Manager for multiple establishments. Also, this role cannot be held concurrently by the employee representative.

◆ File a change notice if the plan content changes.

If the plan period or other content changes after filing, submit a “Career Up Plan Change Notice.” If you previously filed a plan for the same target and the plan period has expired, a change notice is also required.

【Step 2】Add a Regular-Employee Conversion Rule to the Work Rules

To use the “Regular Employee Conversion Course,” your work rules must clearly describe the conversion制度. Please also confirm the following items are specified:

Items to state in the work rules

- Define the coverage of regular employees, fixed-term contract employees, and part-timers.

- For conversions from fixed-term employment, include provisions on contract term.

- State that “bonus or retirement allowance制度” and “pay raises” apply to regular employees.

- Clearly state the conversion制度 (procedure, requirements, timing) in the work rules and ensure it is communicated to employees.

- Provide that at least one of base pay, bonus, retirement allowance, or various allowances has a different amount or calculation method between regular employees and contract/part-time employees.

- If base pay includes a fixed overtime allowance, specify the hours and calculation method for the fixed overtime, and the base pay amount excluding fixed overtime in the work rules or employment contracts.

Notes

◆ You need work rules even with fewer than 10 employees.

If your company has no work rules, you cannot use the grant. Although firms with fewer than 10 employees are not obligated to file work rules, you should first prepare them and ensure the items above are included.

◆ Pay regulations must show a “treatment difference” between regular and non-regular employees.

For base pay, bonus, retirement allowance, and other allowances, set a difference in amounts or calculation methods between regular and non-regular employees.

(Examples) “Regular employees are on monthly salary; contract employees are hourly.” “Bonuses are paid only to regular employees, not to contract employees,” etc.

【Step 3】Convert the Employee Based on the Work Rules

Carry out the conversion to regular status in accordance with the制度 defined in the work rules.

Notes

◆ Conversions before revising the work rules are ineligible.

If you convert an employee before amending the work rules, you will be ineligible for the Career Up Grant “Regular Employee Conversion Course.” Conversions that deviate from the制度 stipulated in the work rules are also ineligible.

【Step 4】Pay Six Months of Wages After Conversion

You must have six months of wage payment records after conversion.

Notes

◆ You must raise pay by at least 3% compared with pre-conversion pay.

Calculate the increase based on the total of base pay and fixed allowances. Do not include travel expense reimbursements or other actual expenses, nor bonuses, in the calculation.

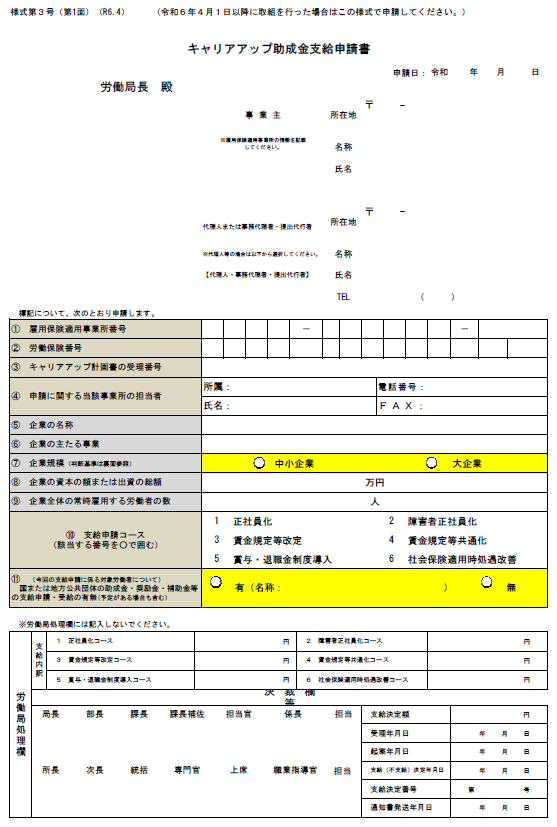

【Step 5】Apply for the Subsidy (Phase 1)

You may file Phase 1 starting the day after you have paid six months of wages as a regular employee.

Notes

◆ If you miss the two-month filing window by even one day, you cannot apply.

File Phase 1 within two months from “the day after the date on which the sixth month’s wages were paid.” If the wage payment date moved earlier due to the calendar, the count starts from the following day—plan carefully.

◆ There are more than 10 required documents.

Including attachments, you will submit 10+ documents. You must also submit one year’s worth of timecards and payroll ledgers, so organize past data for quick reference. If you want to be sure, consider engaging a Labor and Social Security Attorney.

【Step 6】Pay Wages for Months 7–12

Continue employment and pay wages through months 7–12.

In principle, the same as months 1–6 applies; if wages are reduced without a reasonable cause, the subsidy will be denied.

【Step 7】Apply for the Subsidy (Phase 2)

Within two months from the day after the twelfth month’s wages were paid, file the Phase 2 application.

If the Phase 1 decision is “not payable,” you cannot file for Phase 2. As with Phase 1, the actual wage payment date triggers the timeline—watch the dates closely.

3. Required Documents for the Regular Employee Conversion Course

You will submit more than ten documents under the “Regular Employee Conversion Course.”

Because required documents are updated annually, always check the latest information on the Ministry of Health, Labour and Welfare website.

Documents required for payment application

Downloadable from the MHLW website (always use the latest version)

- Career Up Grant Payment Application (Form No. 3)

- Regular Employee Conversion Course Breakdown (Form No. 3 – Attachment 1-1)

- Regular Employee Conversion Course Target Worker Details (Form No. 3 – Attachment 1-2)

- Declaration of Compliance with Eligibility Requirements (Common Guidelines Form No. 1)

- Payment Method / Payee Address Notification (required only if not yet registered)

To be prepared by the company and the employee

- Copy of the “Career Up Plan” certified by the Labour Standards Inspection Office

- Copy of work rules (or labor agreement)

- Copies of the employee’s pre- and post-conversion employment contracts (or written notice of working conditions, etc.)

- Copies of the employee’s pre- and post-conversion payroll ledgers

- Calculation sheet showing the 3%+ wage increase

- Copies of the employee’s pre- and post-conversion attendance records or timecards

- Documents proving SME status (if applying as an SME)

Submitted materials are not returned. Scan or copy all pages before submission.

4. Summary: Career Up Grant “Regular Employee Conversion Course”

In this article, we explained the most commonly used part of the Career Up Grant: the Regular Employee Conversion Course. For employers who want to develop talent while keeping personnel costs under control, this is an attractive制度.

However, there is substantial preparation and internal alignment required, and the volume of application documents is large. Compliance with labor laws and regulations is also reviewed closely in screening.

At Social Insurance & Labor Consultant Corporation Daiichi Sogo office, we support applications for the Regular Employee Conversion Course. If you have questions or concerns, please feel free to consult us.

この記事の監修者

社会保険労務士法人第一綜合事務所

社会保険労務士 菅澤 賛

- 全国社会保険労務士会連合会(登録番号13250145)

- 東京都社会保険労務士会(登録番号1332119)

東京オフィス所属。これまで800社以上の中小企業に対し、業種・規模を問わず労務相談や助成金相談の実績がある。就業規則、賃金設計、固定残業制度の導入支援など幅広く支援し、企業の実務に即したアドバイスを信念とする。